UNITED KINGDOM

SUPPORTING POLICIES FOR OCEAN ENERGY

NATIONAL STRATEGY

The UK Government’s department for Business, Energy and Industrial Strategy (BEIS) retains overall responsibility for energy policy in the UK although powers related to planning, fisheries and the promotion of energy efficiency have been devolved to the governments of Scotland, Wales and Northern Ireland.

Flagship strategic policies of BEIS are having the greatest direct impact on the development of marine energy within the UK. The 2017 UK Government’s Clean Growth Strategy states that ocean energy technologies “could also have a role in the long term decarbonisation of the UK, but they will need to demonstrate how they can compete with other forms of generation.” A progress update for this strategy was published in October 2018 and makes reference to the sector deal made with offshore wind and additional funding granted to the ORE Catapult.

The UK Government’s Industrial Strategy supports the development of the energy sector with ‘clean growth’ one of the four ‘Grand Challenge’ themes underpinning the strategy. The key revenue support system for renewables, including marine energy, is the contracts for difference (CfDs) - also the responsibility of BEIS.

To date, the UK has invested an estimated £508m of private funds into the development of ocean energy technology. This has been supported by £70m of direct public support to technology developers, part of £300m of wider public support (including academia and test centres). To inform budget setting for 2019 onwards the UK Government has convened the Energy Innovation Needs Assessment (EINA) process. This coordination activity will bring together UK Government funding agencies from across the UK to prioritise and allocate R&D investment between the low-carbon technologies, including ocean energy.

UK organisations continue to benefit extensively from European R&D funding with the UK ocean energy sector receiving over €60m from the FP7 and Horizon 2020 programmes, a figure four times higher than the next recipient nation.

To further inform budget setting for 2019 onwards, BEIS commissioned the EINA that brought together UK Government funding agencies from across the UK to prioritise and allocate R&D investment to low-carbon technologies, including ocean energy. In October 2019, the EINA report on Tidal Stream that summarized innovation needs, market barriers and business opportunities for the tidal sector was published. However, post elections, a clear policy for 2020 has yet to be set as it will be included in the next comprehensive spending review.

Scotland

The Scottish Energy Strategy defines the ambitions for the sector through to 2050 also taking a whole-systems approach to the progression towards the equivalent of 50% of heat, transport and electricity consumption sourced from renewable sources. This will enable delivery of Scotland’s flagship Climate Change (Scotland) Act 2009 to reduce Scotland’s greenhouse gas emissions by 80% by 2050. Wave and tidal projects account for 0.02 GW of the total 21.3 GW renewable capacity in Scotland.

Marine Scotland is the Directorate of the Scottish Government responsible for the management and use of Scottish seas, including planning and licencing of marine energy projects. This is administered within the scope of a 2015 National Marine Plan, intended to ensure sustainable use of Scotland’s seas and the resources therein. A 2018 refresh of the Plan focussed mainly on enabling offshore wind development.

Marine Scotland, the Directorate of the Scottish Government responsible for the management of Scottish seas, including planning and licencing of marine energy projects, opened a consultation in November 2019 to seek views on a draft Offshore Renewables Decommissioning Guidance document. The consultation will close in March 2020 ahead of the final publication of the guidance document.

In April 2018, Crown Estate Scotland passed its one-year operative milestone since the Crown Estate’s management duties in Scotland were transferred to the Scottish Government. Managing seabed rights for renewable energy interests from the foreshore to 200 nautical miles (nm), Crown Estate Scotland has an important role to play in enabling marine energy. Applications for ocean energy projects of up to 30 MW are accepted at any time. the first Annual Energy Statement published in 2019 that states the progress alongside the priorities and sets targets for the Scottish Energy Strategy.

The Crown Estate Scotland, which reports to The Scottish Government and manages seabed leasing for renewable energy projects out to 200 nautical miles (nm) will soon operate under The Scottish Crown Estate Act 2019. A new round of leasing for offshore wind in Scotland, ScotWind Leasing, will launch soon but applications for ocean energy projects of up to 30 MW are accepted at any time.

Wales

‘Energy Wales’ was published by the Welsh Government in 2012, and outlines how the Welsh Government intends to grow Wales’ economy in the long term through energy job creation and community benefit from energy infrastructure projects. The Welsh Government has a 70% renewable electricity mix contribution target by 2030, a proportion of which will come from marine sources. To achieve this, the Welsh Governement has allocated £100m of EU structural funding to the Welsh European Funding Office Marine Energy Fund. The fund is aimed at establishing Wales as a centre for marine energy production by increasing the number of wave and tidal energy devices being tested including multi-device array deployments. Most recently, the Welsh Government has awarded €14.9m from the European Regional Development Fund (ERDF) grant to support the next phase of Minesto’s tidal commercial development in Wales. Furthermore, the Welsh National Marine Plan was launched in November 2019 to provide significant support for marine energy technologies.

Marine Energy Wales brings together technology developers, research institutions, supply chain and public sector bodies for establishing a sustainable ocean energy industry in Wales. The 2019 developments recently announced through this organisation include:

- A detailed business case for the £60m Pembroke Dock Marine project focussed on lowering the cost of marine energy was signed by the Swansea Bay City Deal’s Joint Committee;

- The first wave energy marine licence for Bombora for the deployment and testing of their wave energy technology in Wales;

- A new €4.2m Wales-Ireland cross-border project aiming to boost the marine energy industry in both the regions; and

- More than £12m of EU funding to support the next stage of Swansea-based Marine Power Systems’ project to create and launch an underwater device capable of generating clean, affordable and reliable energy in Wales and around the world.

The Marine Centre Wales, which opened in 2018 with £5.5m funding, and the Marine Energy Engineering Centre of Excellence continues to support the Welsh marine sector with resources, skills and collaboration.

Northern Ireland

Northern Ireland’s energy strategy lies within the Department for the Economy (DfE). The DfE has published a vision to 2050 in their Sustainable Energy Action Plan 2012. Related to this, the Strategic Energy Framework 2010-2020 describes a vision of a Northern Ireland powered by affordable, sustainable and low-carbon renewable electricity. Within this Framework sits the Offshore Renewable Energy Strategic Plan (ORESAP) 2012-2020, which also applies to ocean energy.

In 2018, Northern Ireland has progressed the development of a Marine Plan, which aims to maintain a ‘healthy marine area which is managed sustainably for the economic, environmental and social prosperity of present and future generations’. The Marine Renewables Industry Association (MRIA) supports the development of technology in wave, tidal, floating wind and hybrid generation across both Northern Ireland and the Republic of Ireland. In late 2018, MRIA published the ‘Discussion Paper on the Marine Spatial Planning Needs of the Marine Renewables Emerging Technologies’ to support the development of the Marine Plan.

Regional development agency InvestNI continues to support the sector with a particular focus on finding matches between the sector and the Northern Irish supply chain.

Contracts for Difference (CfDs)

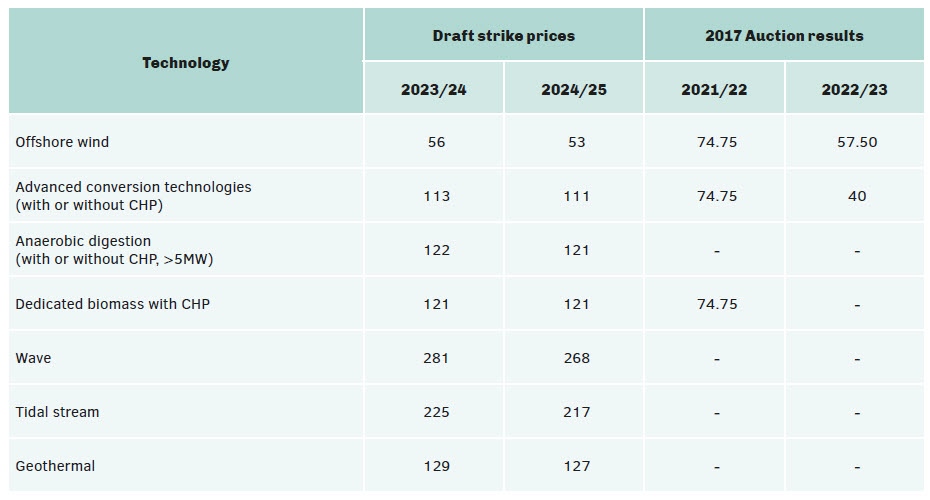

The UK Government continues to offer revenue support to a variety of renewable energy technologies through the Contract for Difference (CfD) programme. Based on top-up payments to a strike price, CfDs offer long-term price stabilisation and are awarded via competitive auctions. Ocean energy technologies are however yet to gain a CfD through the competitive auction process.

The third round of auctions opened in May 2019 delivering record low price for offshore wind; clearing at a price of £39.650/MWh for year 2023/24 and £41.611/MWh for year 2024/25. The announced price was 30% lower than the strike price of £57.50/MWh announced in the previous 2017 CfD auction. Twelve projects, of which six offshore wind, four remote islands wind and two-advanced conversion technology projects secured the contracts. This opens up the possibility for offshore wind contributing heavily towards achieving the Net-Zero target by 2050, but at the same time poses challenges to other low-carbon technologies like ocean energy to match similar cost reductions.

UK Contracts for Difference for less established technologies: Draft strike prices and Auction results (£/MWh |

PUBLIC FUNDING PROGRAMS

In the last few years, the UK Government has made available some public funding alternatives to support the development of the ocean energy sector.

- UK Research and Innovation (UKRI)

In operation since April 2018, UKRI brings together seven research councils to support and coordinate research and innovation in the UK. Independently chaired, UKRI has a £6 billion budget funded primarily through the Science Budget by Business, Energy and Industrial Strategy (BEIS). The research councils and bodies operating within UKRI are the Engineering and Physical Sciences Research Council (EPSRC), Innovate UK, Arts and Humanities Research Council (AHRC), Biotechnology and Biological Sciences Research Council (BBSRC), Economic and Social Research Council (ESRC), Medical Research Council (MRC), National Environment Research Council (NERC), Research England, and the Science and Technology Facilities Council (STFC).In November 2019, the UKRI rolled out invitations for the role of a Champion in Sustainable Management of UK Marine Resources (SMMR). The programme supported by NERC and ESRC in partnership with the Department for Environment, Food and Rural Affairs (DEFRA) and Marine Scotland, shall provide a fund of £12.4M.

- Innovate UK

Innovate UK is a funding body that supports businesses in their development of new technologies and concepts, helping them to reach commercial success. Innovate UK awards grant and loan funding across all sectors to business-led and high-value innovation in the UK. The organisation also cultivates networks between innovators and investors, researchers, other sectors, policymakers and future customers on a domestic and international scale. Innovate UK is also a member of UKRI.

- Wave Energy Scotland

WES – fully funded by the Scottish Government – is taking an innovative and unique approach to the development of wave technology in a research programmes. WES funds the progression of innovative technology to commercialisation through stage-gate funding. Three levels of calls fund projects through initial to prototype testing stages. Funding is allocated within four categories of technological requirements, concerning internal components, overall WEC design, materials and manufacturing.